operating cash flow ratio industry average

Additionally a more conservative approach is used to verify so the credit analysts calculate again using EBIT along with. Say you have 100000 in Total Assets and.

Price To Cash Flow Ratio Formula Example Calculation Analysis

This may signal a need for more capital.

. Had a cash flow ratio of. Cash flow coverage ratio 80000000 38000000 2105. Cash ratio is a refinement of quick ratio and.

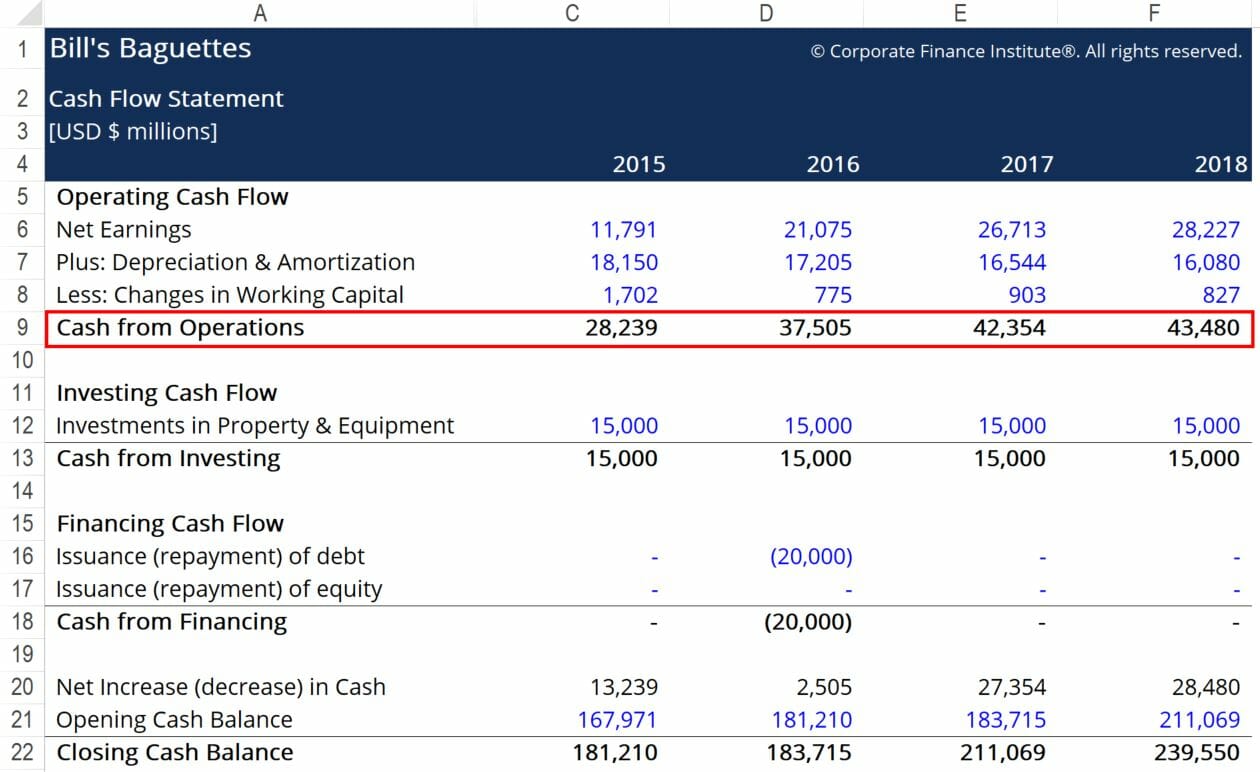

If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. The average for each of these annual figures over the complete 20 year period was 143Compare this to the 89 average from the research I did on historical average net.

Alternatively the formula for cash flow from operations is. 75 rows Cash Ratio - breakdown by industry. Cash returns on assets cash flow from operations Total assets.

The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations. Cash equated to 91 of sales by end-FY16 up from 78 three years earlier while debt was just 12 of sales. This corresponds to a value of 1 or little higher than 1.

Operating Margin Income Tax Rate Net Profit Margin Return on. Due to repayements of liabilities of 246 Industry improved Liabilities to Equity ratio in 1 Q 2022 to 143 above Oil And Gas Production Industry average. These Cash Flow-Solvency Ratios are included for every year of every Industry Financial report.

Total Capital Return on Shareholder Equity Retained Earnings to. Industry Financial reports offer up to ten years of. Lets consider the example of an automaker with the following financials.

Average industry financial ratios for US. The operating cash flow ratio is a measure of a companys liquidity. Price-to-Operating-Cash-Flow explanation calculation historical data and more.

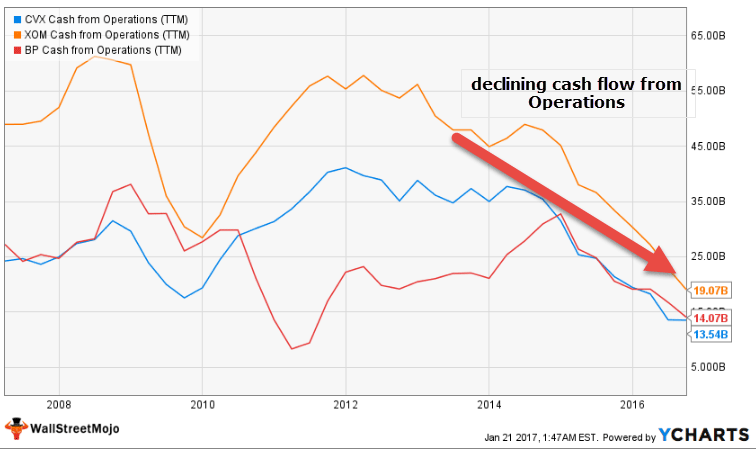

Among other Industries in the Energy. The formula for calculating the operating cash flow ratio is as follows. The cash flow coverage ratio is considered a solvency ratio so it is a long-term ratio.

CFO Ratio 77434 Mn 116866 Mn. Industry Ratios included in Value Line. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance.

Price-to-Operating-Cash-Flow as of today June 03 2022 is. Median recommended average Financial ratio. For example an Assets to Sales Ratio Total Assets Net Sales.

All Industries Measure of center. CFO Ratio 066. Some key financial ratios investors and market analysts use to evaluate companies in the healthcare sector include the cash flow coverage ratio the debt-to.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. 220 rows Operating cash flow ratio Operating cash flow Current liabilities. On the trailing twelve months basis Airline Industry s Cash cash equivalent grew by 12579 in the 2 Q 2021 sequentially faster than Current Liabilities this led to improvement in Airline Industrys.

In depth view into. A ratio shows how many times the first number contains the second number. Any of a number of ratios measuring a companys operating efficiency such as sales to cost of goods sold net profit to gross income operating expense to operating income.

Strong recurring free cash. This ratio calculates whether a company can pay its obligations on its total debt. Example of Cash Returns on Asset Ratio.

In other words SMCs cash balance was 75x its debt. Operating cash flow ratio measures the adequacy of a companys cash generated from operating activities to pay its current liabilitiesIt is calculated by dividing the cash flow. However there is a crucial difference.

The formula to calculate the ratio is as follows. Cash Flow from Operations Ratio Cash Flow from Operations Current Liabilities.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Cash Flow Per Share Formula Example How To Calculate

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow And Business Combinations The Cpa Journal

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Price To Cash Flow Formula Example Calculate P Cf Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Formula Example Calculate P Cf Ratio

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow To Debt Ratio Meaning Importance Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Liquidity Ratio Formula And Calculation Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute